When investing for current income, fixed-income funds are excellent investment vehicles for consistent and reliable income. Fixed-income fund are also referred to as bond funds.

As mutual funds, fixed-income fund offer ease and convenience in investing, along with professional management and the opportunity to automatically spread your risk over many different investments.

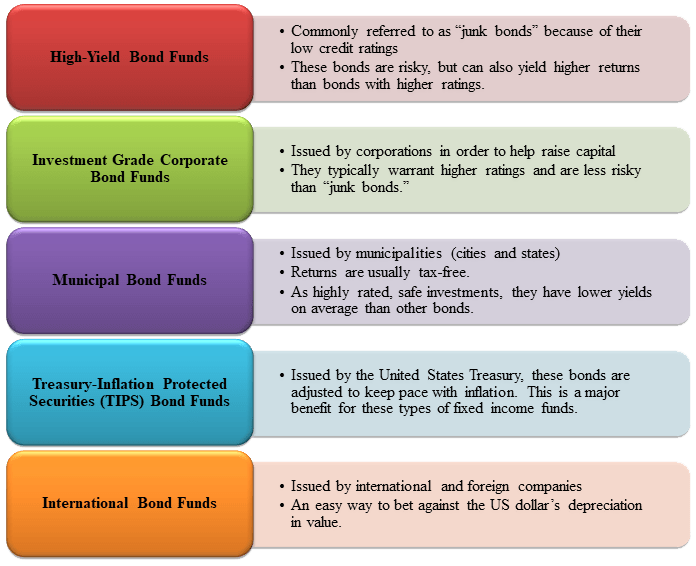

The different types of fixed-income fund are characterized by which type of bond they invest in. Just like bonds, these funds offer different levels of risk and return to meet your needs.

Always remember:

- The lower the rating, the higher the risk and rate of return

- The higher the rating, the lower the risk, providing a very secure source of income

Let’s take a look at the different types of fixed-income fund.

Fixed-income fund are a great way to make safe investments that provide stable returns and low risk. If you’re looking for a way to invest for your current income, choosing your fixed-income fund based on the amount of risk that you’re willing to take will help you avoid any unpleasant surprises.